מושגי ליבה

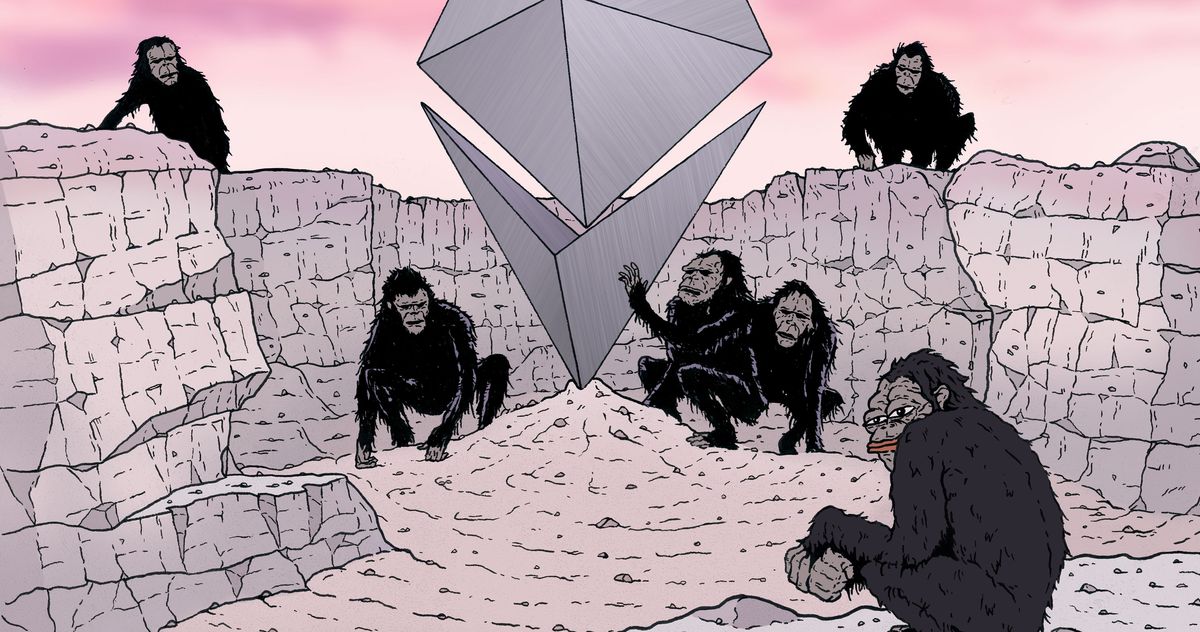

The author explores the evolving concept of money in the modern era through the lens of NFTs, SPACs, meme stocks, and cryptocurrency, highlighting a shift in how society perceives and interacts with financial assets.

תקציר

In a world where NFTs, meme stocks, and cryptocurrencies dominate headlines, the article delves into the changing landscape of money. From the rise of non-fungible tokens to the influence of social media on financial decisions, it questions traditional views on wealth accumulation. The narrative navigates through various financial anomalies like GameStop's stock surge and pandemic relief payments that challenge conventional economic wisdom. As money takes on new forms and meanings, the author contemplates its role in shaping individual lives and societal structures amidst technological advancements and economic uncertainties.

You’re Not Crazy. Money Is.

סטטיסטיקה

"156 million Americans have received $372 billion from Treasury Department."

"22 million people lost their jobs during the pandemic."

"Elon Musk can cause a defunct penny stock to rise 6,000 percent with a single tweet."

ציטוטים

"Money has been reanimated from the suspension of settled policy consensus."

"Money is only experienced through our phones, as a number on a screen."

תובנות מפתח מזוקקות מ:

by Max Read ב- nymag.com 04-12-2021

https://nymag.com/intelligencer/2021/04/nft-future-of-money.html

שאלות מעמיקות

What societal implications arise from the changing perception of money beyond financial markets?

The changing perception of money beyond financial markets has significant societal implications. As money becomes more digitized and abstract, it can lead to a detachment from the tangible value it represents in the real world. This shift may contribute to a sense of disconnection between individuals and their understanding of wealth, potentially leading to increased financial inequality as those who are more adept at navigating digital platforms for monetary transactions gain an advantage over others.

Moreover, the proliferation of new forms of currency such as cryptocurrencies and NFTs could exacerbate existing social disparities. Those with access to these emerging assets may see their wealth grow exponentially while others struggle to keep pace or even comprehend these new financial instruments. This disparity in financial literacy and access could widen social divides and create new forms of economic exclusion.

Is there a risk in relying heavily on digital platforms for monetary transactions?

Relying heavily on digital platforms for monetary transactions poses several risks that need to be considered. One primary concern is cybersecurity threats, as digital transactions are vulnerable to hacking, data breaches, and identity theft. The increasing interconnectedness of our financial systems through online platforms makes them attractive targets for cybercriminals seeking to exploit vulnerabilities in these networks.

Additionally, there is a risk of technological failures disrupting or halting digital transactions altogether. System outages or glitches could result in individuals being unable to access their funds or make essential payments, causing widespread inconvenience and potential financial losses.

Furthermore, the reliance on digital platforms raises issues related to privacy and surveillance. Financial institutions and tech companies have unprecedented access to personal data through online transactions, raising concerns about how this information is used, stored, and shared without individuals' consent.

How does the evolution of money impact traditional economic theories and practices?

The evolution of money has profound implications for traditional economic theories and practices. The emergence of alternative currencies like cryptocurrencies challenges conventional notions about the role of central banks in controlling monetary supply and regulating economies. These decentralized forms of currency operate outside established regulatory frameworks, posing challenges for policymakers seeking to maintain stability within traditional economic models.

Moreover, the rise of non-fungible tokens (NFTs) blurs the lines between physical assets and virtual commodities in ways that challenge traditional concepts around value creation and exchange mechanisms. NFTs introduce novel ways for artists and creators to monetize their work directly without intermediaries but also raise questions about ownership rights enforcement within existing legal frameworks.

Overall, as new technologies continue reshaping how we perceive value exchange mechanisms beyond fiat currencies or physical assets like gold or real estate—traditional economic theories must adapt accordingly—to account for these disruptive forces shaping modern finance landscapes.

0