Analysis of the Best Performing Investments from 1800 to the Present

Core Concepts

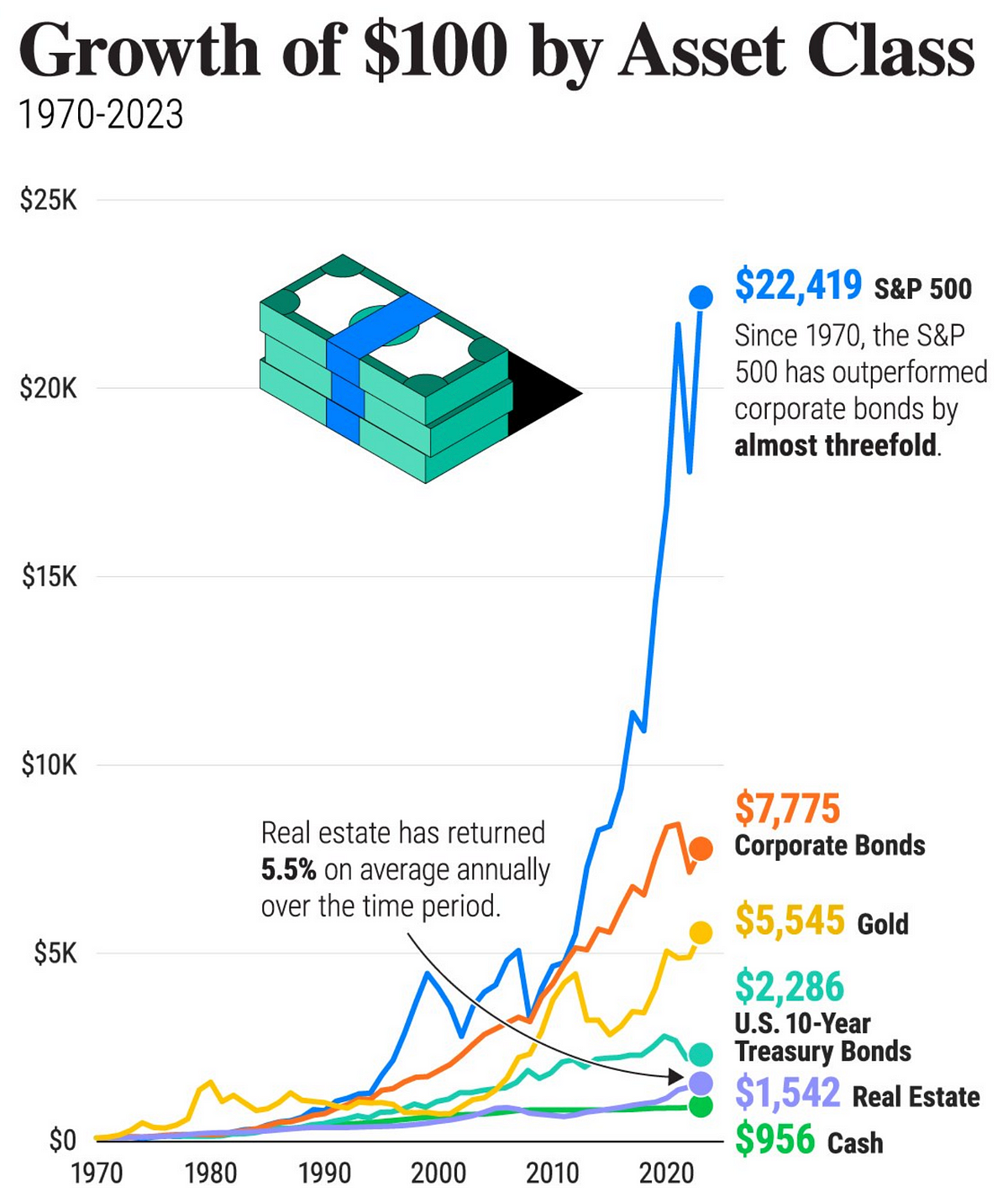

Equities and real estate have been the best-performing asset classes for long-term capital growth, despite periodic crises, outperforming government bonds and cash.

Abstract

The content provides an analysis of the historical performance of different asset classes since 1800. It highlights the following key insights:

During the 19th century, when countries operated under the gold standard, monetary stability was remarkable despite social and political upheavals. However, gold itself did not provide significant investment returns, reflecting the low inflation and price stability of the era.

Equities and real estate have proven to be the best drivers of capital growth over the long term. Despite periodic crises, these assets have generally outperformed government bonds and cash, especially in the long run.

The analysis suggests that studying the historical performance of different asset classes under varying economic and political conditions can provide valuable insights for investment strategies.

I’ve Analyzed the Best Investments since 1800!

Stats

Equities and real estate have generally outperformed government bonds and cash in the long run.

Quotes

"Equities and real estate have proven to be the best drivers of capital growth over the long term."

"Despite periodic crises, these assets have generally outperformed government bonds and cash, especially in the long run."

Key Insights Distilled From

by The Pareto I... at medium.com 04-18-2024

https://medium.com/@pareto_investor/ive-analyzed-the-best-investments-since-1800-0798d8b778dc

Deeper Inquiries

What factors have contributed to the long-term outperformance of equities and real estate compared to other asset classes?

Equities and real estate have outperformed other asset classes over the long term due to several key factors. Firstly, both equities and real estate have the potential for capital growth, as they are tied to the growth of the economy and the underlying assets. Equities represent ownership in companies that can generate profits and increase in value over time. Real estate, on the other hand, benefits from appreciation in property values and rental income.

Additionally, equities and real estate offer diversification benefits that can help mitigate risk in an investment portfolio. By investing in a mix of different companies or properties, investors can spread out their risk and potentially achieve higher returns. Moreover, these asset classes have historically shown resilience in the face of economic downturns, as they have the ability to adapt to changing market conditions and generate returns over the long term.

How have the investment returns of different asset classes been affected by changes in monetary policies and economic regimes over the past two centuries?

Changes in monetary policies and economic regimes have had a significant impact on the investment returns of different asset classes over the past two centuries. For example, during the era of the gold standard in the 19th century, countries experienced remarkable monetary stability, which had implications for asset performance. Assets like gold, which were directly tied to the gold standard, provided a stable monetary base but did not offer significant investment returns due to low inflation and price stability.

In contrast, shifts away from the gold standard and the adoption of different monetary policies have influenced the performance of asset classes like equities and real estate. Changes in interest rates, inflation rates, and government regulations can affect the returns generated by these assets. For instance, periods of high inflation may erode the real value of fixed-income investments like government bonds, while equities and real estate may benefit from inflation hedging properties.

What lessons can be drawn from this historical analysis to guide investment decisions in the current economic and political landscape?

From this historical analysis, several lessons can be drawn to guide investment decisions in the current economic and political landscape. Firstly, it is essential to recognize the long-term outperformance of equities and real estate compared to other asset classes. Investors should consider allocating a portion of their portfolio to these assets to benefit from capital growth potential and diversification benefits.

Moreover, understanding the impact of monetary policies and economic regimes on asset performance can help investors navigate changing market conditions. Keeping abreast of central bank policies, inflation trends, and geopolitical developments can inform investment decisions and asset allocation strategies. By diversifying across different asset classes and staying informed about macroeconomic factors, investors can position themselves to achieve long-term financial success in the current economic and political environment.

0