Navigating Startup Success and Venture Capital Realities

Core Concepts

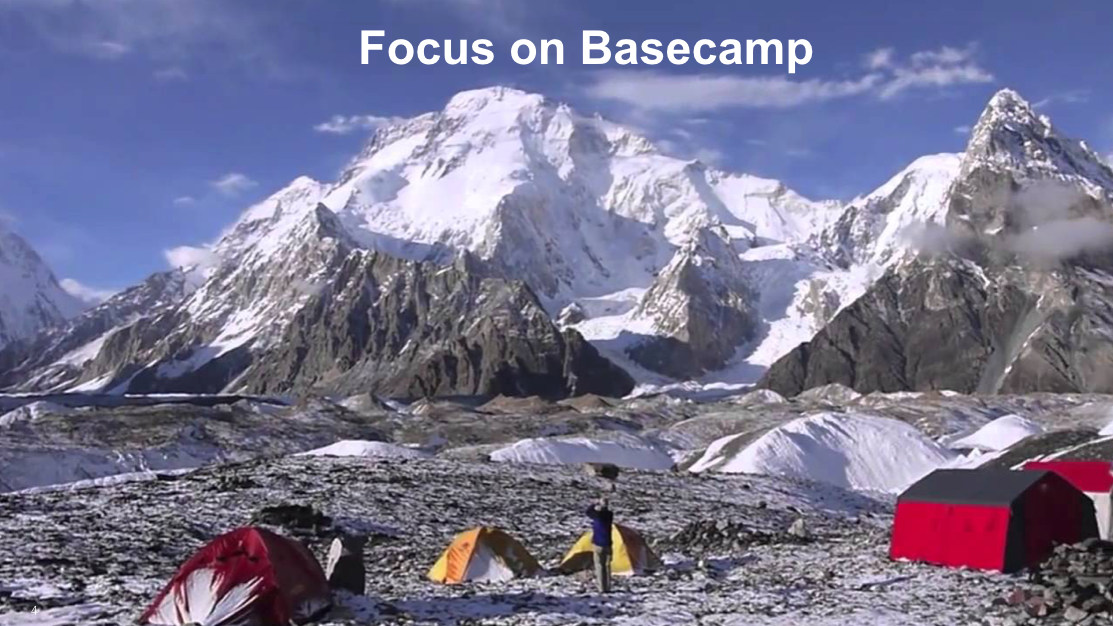

Focus on achieving initial success at "basecamp" before aiming for higher goals in a startup. Understand the importance of deflationary economics and venture capital dynamics in building a successful business.

Abstract

Many first-time founders are misled into believing they need a billion-dollar idea to start a successful startup. The key is to focus on reaching "basecamp," the initial level of success, before scaling further. Understanding deflationary economics and venture capital economics is crucial for sustainable growth in the startup ecosystem.

How to Build a Startup & Understanding Venture Capital

Stats

Uber started as an elite black-car service before launching UberX after observing Lyft's success.

Facebook initially targeted college campuses, while Twitter began as a podcasting company.

Venture capitalists aim to return 4x the amount they raise to their Limited Partners (LPs).

Quotes

"There are very few ideas that are obviously a billion-dollar idea from the start."

"Focus on what I call 'basecamp,' which is the first level of success or validation at a startup."

Key Insights Distilled From

by Mark Suster at bothsidesofthetable.com 07-26-2016

https://bothsidesofthetable.com/how-to-build-a-startup-understanding-venture-capital-54ba55abf1e6

Deeper Inquiries

How can focusing on "basecamp" benefit startups in the long run?

Focusing on "basecamp" can benefit startups in the long run by providing a clear and achievable initial goal for the company. By concentrating on reaching basecamp, founders can avoid getting overwhelmed by trying to achieve a billion-dollar idea right from the start. This approach allows them to raise only the necessary funds and build a team that is essential for reaching this first level of success or validation. Once at basecamp, founders gain valuable insights into their business, market, and potential growth opportunities. They can then make more informed decisions about the next steps to take in scaling their startup. Additionally, starting with basecamp helps founders assess whether their current idea has potential or if pivoting towards a new concept might be more promising.

What are the risks associated with not considering deflationary economics in business strategies?

Not considering deflationary economics in business strategies poses significant risks for startups. In today's competitive landscape, where technology enables rapid innovation and disruption across industries, failing to focus on lowering prices, improving functionality, and increasing market size through Internet scale can leave companies vulnerable to being outpaced by competitors who do embrace these principles. Ignoring deflationary economics may result in businesses offering products or services that become outdated or overpriced compared to what rivals are delivering. This could lead to loss of market share, reduced profitability, and ultimately failure for the startup as customers gravitate towards more cost-effective solutions offered by competitors who have adopted deflationary strategies.

How does understanding venture capital dynamics impact entrepreneurial decisions?

Understanding venture capital dynamics is crucial for entrepreneurs as it influences key decisions regarding fundraising, growth strategy, and overall business trajectory. Venture capitalists typically aim to generate high returns for their investors (Limited Partners) by investing in startups with significant growth potential that can deliver substantial exits down the line. Entrepreneurs who grasp these dynamics are better equipped to tailor their pitches and business plans to align with VC expectations and requirements. They can strategically position their startup as an attractive investment opportunity by showcasing scalability, market traction, revenue projections aligned with VC return goals.

By comprehending how VCs operate – including fund structures like 4x return targets – entrepreneurs gain insights into what drives investor interest and funding decisions within the venture capital ecosystem.

0