Physicians' Attitudes Towards Taxes Revealed in Medscape Report

Core Concepts

Physicians exhibit positive attitudes towards taxes but remain wary of Congress's actions.

Abstract

Physicians, despite being high earners, show positive attitudes towards government taxation and satisfaction with paid preparers. However, they express suspicion towards Congress's tax policies. The content introduces findings from the 2023 Physicians and Taxes Report by Medscape, inviting readers to explore further details.

Key Highlights:

Physicians' positive attitudes towards taxation.

Satisfaction with paid preparers.

Suspicion towards Congress's tax policies.

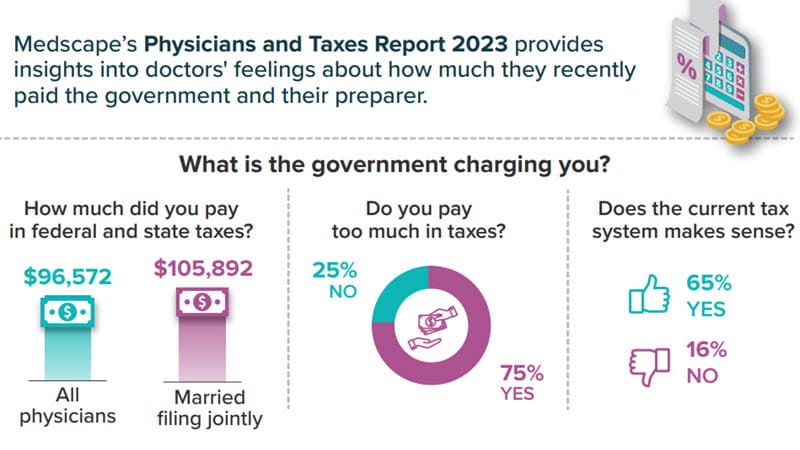

Infographic: How Physicians React to Their Tax Bill

Stats

Physicians have more positive attitudes than expected towards federal and state taxation.

They are satisfied with the work of their paid preparers.

Physicians are suspicious about Congress's actions on taxes.

Quotes

"Physicians have more positive attitudes than one might expect from high earners in regard to how much federal and state governments tax Americans."

"They are suspicious about what to expect from Congress on the tax front."

Key Insights Distilled From

by Jon Mckenna at www.medscape.com 08-18-2023

https://www.medscape.com/viewarticle/995237

Deeper Inquiries

How do physicians' attitudes towards taxes compare to other high-earning professions

Physicians generally exhibit more positive attitudes towards taxes compared to other high-earning professions. Despite being in a high-income bracket, physicians seem to have a level of acceptance towards the amount of taxes imposed by federal and state governments. This positive attitude could stem from their understanding of the necessity of taxes in funding public services and infrastructure. Additionally, physicians may also appreciate the role taxes play in supporting healthcare programs and initiatives, which are directly relevant to their profession.

What factors contribute to physicians' satisfaction with paid preparers

Several factors contribute to physicians' satisfaction with paid preparers when it comes to handling their taxes. Firstly, the competence and expertise of the preparer play a significant role. Physicians are likely to be satisfied when their preparers demonstrate a deep understanding of tax laws and regulations, especially those specific to healthcare professionals. Clear communication and transparency in the tax preparation process also contribute to satisfaction. Physicians value preparers who can explain complex tax matters in a way that is easy to understand. Timeliness and accuracy in filing taxes are crucial factors that contribute to physicians' satisfaction with paid preparers.

How can physicians actively engage with Congress on tax policies to address their suspicions

Physicians can actively engage with Congress on tax policies by leveraging their professional organizations and networks. They can work together with medical associations to advocate for tax policies that are favorable to healthcare professionals. Physicians can also participate in lobbying efforts to voice their concerns and suggestions regarding tax reforms. Engaging in discussions with lawmakers, attending congressional hearings related to tax policies, and providing expert testimony can help physicians influence tax legislation. By staying informed about tax proposals and actively participating in the legislative process, physicians can address their suspicions and contribute to shaping tax policies that align with their interests.

0