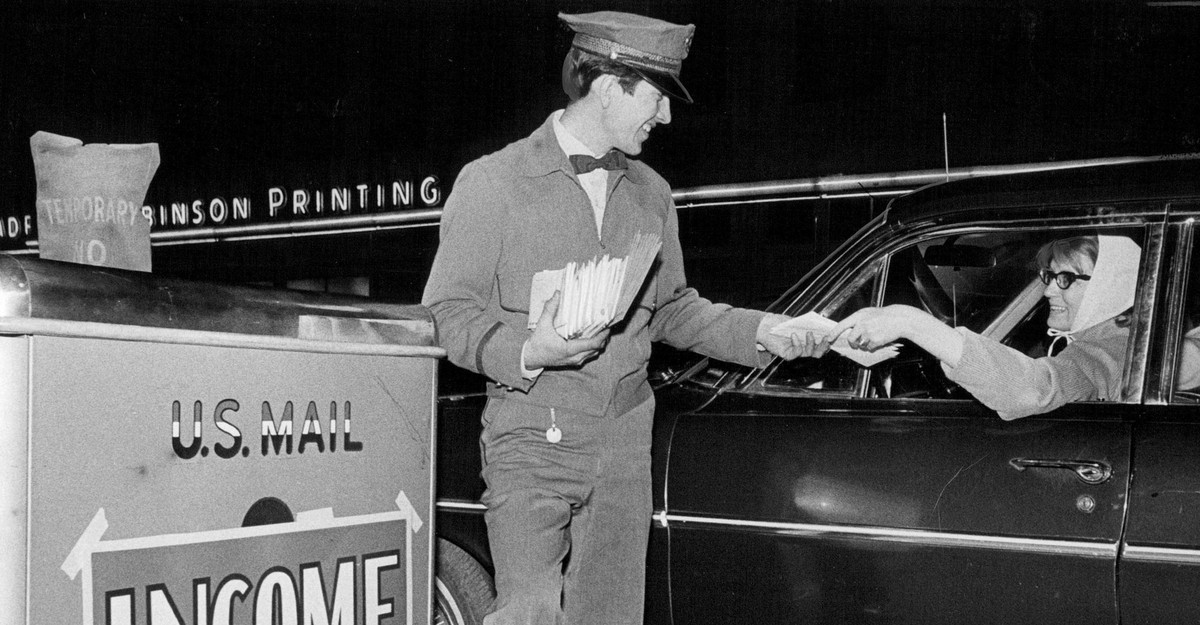

The U.S. tax code has historically privileged white families over Black families, creating disparities in taxation that persist to this day. The joint return policy, initially designed to benefit married couples with a single wage-earner, disproportionately favored white couples and disadvantaged Black couples. Over time, changes in tax laws have further exacerbated these inequalities, leading to marriage penalties for many Black households despite similar income levels compared to their white counterparts.

The historical context of how the tax system evolved reveals deep-rooted racial biases that continue to impact Black Americans' financial well-being. The author advocates for a return to individual tax returns as a solution to address these systemic inequities and promote racial justice in taxation.

Customize Summary

Rewrite with AI

Generate Citations

Translate Source

To Another Language

Generate MindMap

from source content

Visit Source

www.theatlantic.com

How the U.S. Tax Code Privileges White Families

Key Insights Distilled From

by Dorothy A. B... at www.theatlantic.com 03-23-2021

https://www.theatlantic.com/ideas/archive/2021/03/us-tax-code-race-marriage-penalty/618339/

Deeper Inquiries